Schwab shares our commitment to meeting your needs and championing your financial goals with integrity.

What's an IRA?

An individual retirement account, or IRA, is a personal retirement savings account.

Even if you've signed up for an employer-sponsored plan like a 401(k), 403(b) or TSP, you can still open an IRA to boost your savings and add flexibility to your budget.

Here are some investments you can make inside an IRA:

- Stocks

- Mutual funds and exchange-traded funds, or ETFs

- Bonds and CDs

- Target date funds

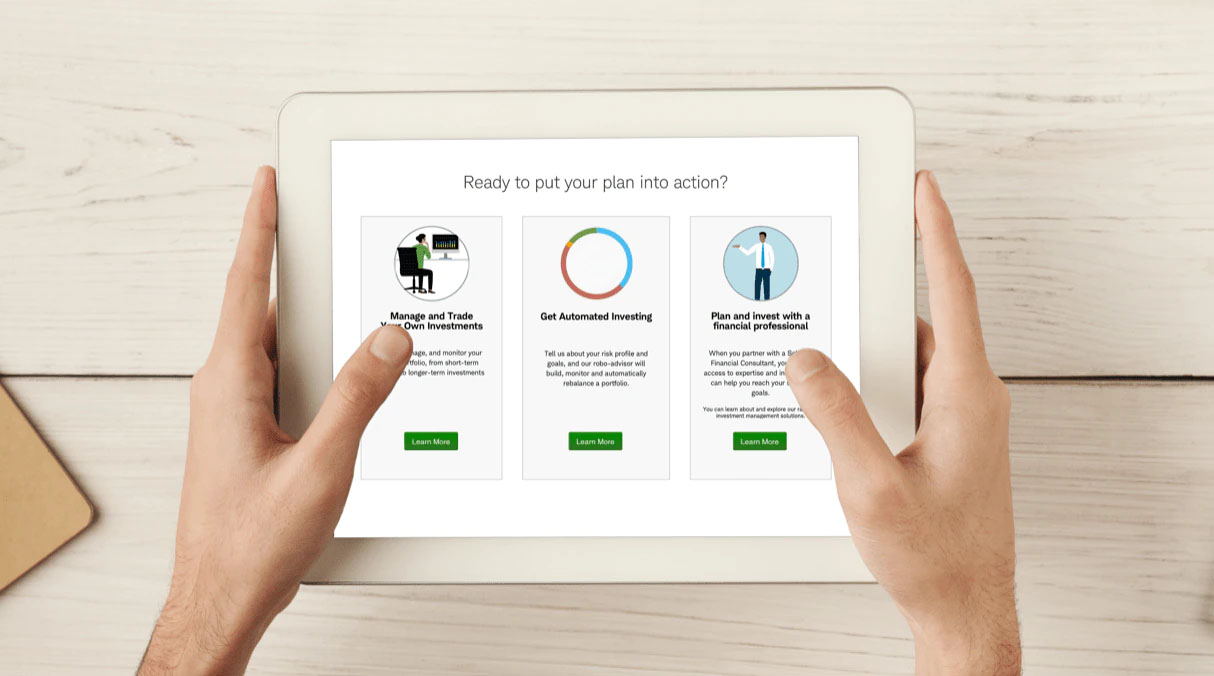

Get on track with a complimentary financial plan.

Saving for retirement is one of the most important goals you can have. That's why Schwab offers a complimentary digital financial plan with every account. Find out what it'll take to retire the way you want.

See your accounts in one place.

You can view your Schwab accounts alongside your USAA accounts — all without leaving usaa.com or our mobile app. Check your general information and balance with us or go straight to schwab.com with no additional logon required to manage your account.

IRA and rollovers FAQ

- Social Security number

- Driver's license

- Employer's name and address if you have one

- Statement information for assets or cash you'd like to transfer

You'll need to open an IRA at Schwab and complete any forms required by your former employer. Before you roll over your 401(k) or TSP, review all your options so you can make the right choice.

Important information from USAA Investment Services Company (ISCO):

Review our relationship with you in our Relationship Summary PDF.

Important information from Schwab:

Investors should consider carefully information contained in the prospectus, or if available, the summary prospectus, including investment objectives, risks, charges and expenses. You can request a prospectus by calling 800-435-4000. Please read the prospectus carefully before investing.

Learn more about USAA Investment Services Company or Charles Schwab on FINRA's BrokerCheck website.