USAA Life Insurance Company

The purpose of this communication is a solicitation of insurance. Contact may be made by an insurance agent or insurance company.

Medicare Supplement (MEDIGAP)

Medicare Supplement Insurance (MEDIGAP)

Medigap plans in California offer peace of mind.

Get help paying the out-of-pocket expenses you have with Medicare.

Have questions but don't want to wait on hold?

Speak with a licensed insurance agent when it's convenient for you.See note1

Or call us when you're ready at 800-531-9164.

For a TTY device, dial 711.

Hours of operation(opens popup)What is a Medicare Supplement plan?

A Medicare Supplement plan is also called a Medigap plan. That's because it helps fill in the gaps in Original Medicare coverage. Unlike a Medicare Advantage Plan, a Medigap policy isn't an alternative to Medicare Parts A and B. Instead, it adds to those benefits. Medigap plans typically come with higher premiums than Medicare Advantage Plans but may have lower out-of-pocket costs.

If you're enrolled in Original Medicare, you can choose a Medigap plan from a private insurer. Plan benefits work with any hospital or doctor that accepts Medicare.

Why choose Medicare Supplement Insurance?

This insurance offers the freedom to choose who provides your care and where you receive it.

-

Flexible Coverage

See any doctor who accepts Medicare nationwide. And you don't normally need a referral to visit a specialist.

-

Guaranteed Renewal

As long as you pay your premiums, your plan is guaranteed to renew — even if your health changes.2

-

Simpler Budgeting

Plans can help you manage the costs Medicare doesn't cover, including copayments, coinsurance and some deductibles. So, you'll be more confident in budgeting for health care expenses.

Compare Medicare Supplement plans.

While Medicare is split into parts, Medicare Supplement coverage varies by plan.

This chart shows what is covered under different Medicare Supplement plans in Texas.

Return to our Medicare Options page to select a new state.

Change stateThe content on this website has been reviewed, but not approved by the Oregon Division of Financial Regulation.

= 100%

Scroll table sideways for additional info

| Features Features | Plan A** | Plan B | Plan C | Plan D | Plan F* | Plan G | Plan N |

|---|---|---|---|---|---|---|---|

| Medicare Part A coinsurance and hospital costs For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Medicare Part B coinsurance or copayment For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered ** |

| Blood (first 3 pints) For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Hospice Care Coinsurance or Copayment For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Skilled nursing facility care coinsurance For Opens Popup | Not Covered | Not Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Medicare Part A Deductible For Opens Popup | Not Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Medicare Part B Deductible For Opens Popup | Not Covered | Not Covered | 100 Percent Covered | Not Covered | 100 Percent Covered | Not Covered | Not Covered |

| Medicare Part B Excess Charges For Opens Popup | Not Covered | Not Covered | Not Covered | Not Covered | 100 Percent Covered | 100 Percent Covered | Not Covered |

| Foreign Travel Emergency For Opens Popup | Not Covered | Not Covered | 80% Covered | 80% Covered | 80% Covered | 80% Covered | 80% Covered |

-

Plans C and F are only available to individuals who were Medicare eligible prior to Jan. 1, 2020.

-

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that do not result in an inpatient admission.

How to get a Medicare Supplement plan

Though coverage among plan types is standard, premiums can vary between insurers. Be sure to review coverage and premium details before choosing a USAA plan.

-

1. Sign up for Medicare.

To be eligible for a plan, you need to be enrolled in Original Medicare. It's best to enroll in Medicare Parts A and B during your seven-month Initial Enrollment Period (IEP). To learn more about signing up for Original Medicare, you can visit medicare.gov.

-

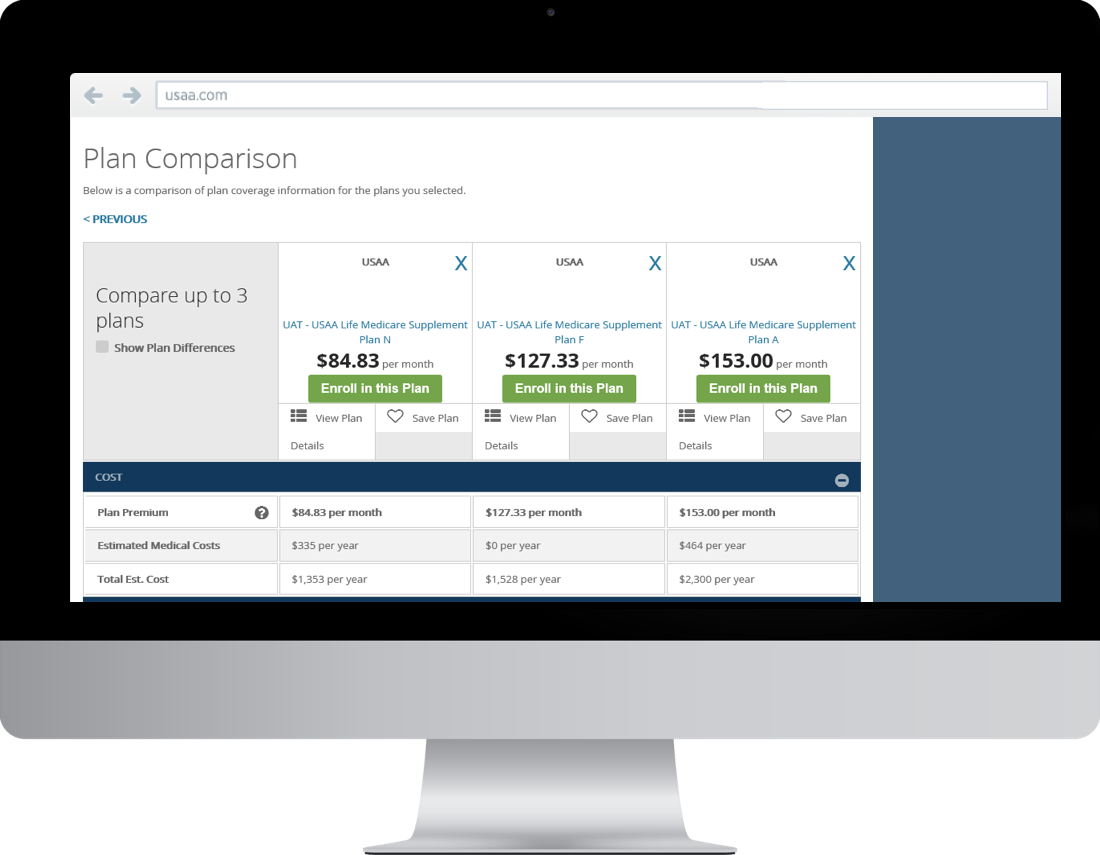

2. Compare plans before you apply.

Reviewing coverage and costs online could help you find the plan you need. It's best to apply after getting Original Medicare and during the six-month enrollment period starting the first day of the month you turn 65. After this, your health history may be considered by insurers when you apply.

-

3. Add additional coverage.

For drug coverage, you may need to pair a stand-alone prescription drug plan with a Medigap policy. You can also add separate dental, vision or hearing plans to your policy.

Medicare Supplement FAQ

A Medicare Supplement plan works with your Original Medicare to cover some of your out-of-pocket health care costs.

There are several types of supplemental plans, which are identified by letters. The benefits included with each lettered plan are the same across insurers, but premium costs can vary. Plan availability can also differ by state. The plans don't include prescription drug coverage.

As you consider your plan options, it's important to compare costs since premiums can vary among insurers. Be sure to weigh the costs against the amounts and types of coverage the plan provides. Plans with more coverage often have higher premiums.

Your Initial Enrollment Period (IEP) is when you're first eligible to sign up for Medicare Parts A and B. It spans seven months and starts three months before you turn 65 and includes your birthday month. Your IEP ends three months after you turn 65 — on the last day of that month.

The Medigap Open Enrollment Period refers to the six-month period when you're first eligible to get a Medigap plan. It starts the first day of the month you turn 65. To get a plan during this time, you must be enrolled in Medicare Parts A and B.

Your medical history won't be considered by insurers if you enroll in a Medicare Supplement plan during your Medigap Open Enrollment Period. If you want to enroll after this period, the insurance company may review your health history when deciding if they'll accept your application.

Find a Medigap plan that fits you well.

Compare coverage and costs to find a Medicare Supplement Insurance plan.

For help, call a licensed insurance agent at 800-531-9164.call a licensed insurance agent at 800-531-9164.1

For a TTY device, dial 711.

USAA Life Insurance Company

The purpose of this communication is a solicitation of insurance. Contact may be made by an insurance agent or insurance company.

Medicare Supplement (Medigap)

Add to your Medicare coverage.

Call a licensed insurance agent at 877-842-5883877-842-5883.

For TTY device, dial 711.

Medicare Supplement (Medigap)

Add to your Medicare coverage.

Call a licensed insurance agent at 877-842-5883877-842-5883.

For TTY device, dial 711.

Why choose a Medicare Supplement Insurance plan?

Medicare Supplement plans may help with the costs that Medicare leaves you with, like copayments, coinsurance and deductibles. Medicare Supplement Insurance costs vary by plan. They typically come with higher premiums than Medicare Advantage but may have lower out-of-pocket costs. You can compare costs when you choose a plan.

-

Keep Your Doctors

You may see any doctor that accepts Medicare under a Medicare Supplement plan.

-

Get Wide Coverage

You may use your plan with Medicare providers anywhere in the country. Some plans even offer emergency coverage overseas.

-

Guarantee Renewal

Medicare Supplement Insurance plans are renewable, regardless of your health condition, as long as you pay your premiums.

Medicare Supplement Insurance doesn't cover prescription drugs. Consider pairing your Medicare Supplement plan with a Prescription Drug Plan.

Need more information to help you choose the right plan?

Call a licensed insurance agent at 877-842-5883 Call a licensed insurance agent at 877-842-5883

Call a licensed insurance producer at 877-842-5883 Call a licensed insurance producer at 877-842-5883

For TTY device, dial 711.

(Hours of operation Opens Popup)Compare Medicare Supplement Plans

While Medicare is split into parts, Medicare Supplement coverage varies by plan.

This chart shows what is covered under different Medicare Supplement plans in Texas.

Return to our Medicare Options page to select a new state.

Change stateThe content on this website has been reviewed, but not approved by the Oregon Division of Financial Regulation.

= 100%

Scroll table sideways for additional info

| Features Features | Plan A** | Plan B | Plan C* | Plan D | Plan F* | Plan G** | Plan N |

|---|---|---|---|---|---|---|---|

| Medicare Part A For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Medicare Part B For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered ****** |

| Blood Transfusions (Up to 3 Pints) For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Hospice Care Coinsurance or Copayment For Opens Popup | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Skilled Nursing Facility For Opens Popup | Not Covered | Not Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Medicare Part A Deductible For Opens Popup | Not Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered | 100 Percent Covered |

| Medicare Part B Deductible For Opens Popup | Not Covered | Not Covered | 100 Percent Covered | Not Covered | 100 Percent Covered | Not Covered | Not Covered |

| Medicare Part B Excess Charges For Opens Popup | Not Covered | Not Covered | Not Covered | Not Covered | 100 Percent Covered | 100 Percent Covered | Not Covered |

| Foreign Travel Emergency For Opens Popup | Not Covered | Not Covered | 80% Covered | 80% Covered | 80% Covered | 80% Covered | 80% Covered |

-

If you become eligible for Medicare on or after Jan. 1, 2020, the Medicare Supplement plans available to you won't cover the Part B deductible. This means that Plans C and F will not be available to you. If you bought one of these plans before Jan. 1, 2020, you'll be able to keep it. If you were eligible for Medicare before that date but did not enroll, you may be able to buy one of these plans.

-

Plan G is only available by phone in Texas.

Call a licensed agent at 800-515-8687

-

Under 65: In Oregon, Medicare Supplement Plans A, F, G and N are available to qualified individuals under age 65 who are eligible for Medicare by reason of disability and/or end stage renal disease.

-

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that do not result in an inpatient admission.

Start shopping for a Medicare Supplement.

- Get quotes for plans in your area.

- Compare plan benefits side by side.

- Check how your prescriptions are covered.

How to Use Medicare Supplement

-

Let's say you go to the doctor for Medicare-covered services.

-

You'd pay any copay at the time of service, unless you have a plan with no copays.

-

The bill is then sent to Medicare to pay its share.

-

We'll pay some or all of what's left, depending on your plan.

How to Get a Medicare Supplement Plan

-

1. Enroll in Medicare

You'll get a confirmation letter from the government with your Medicare effective date, which must include Parts A and B.

-

2. Apply for Medicare Supplement

You'll take this step when you sign up during your Medicare Initial Enrollment Period.

Get started Applying for Medicare Supplement -

3. Consider More Coverage

You may consider other coverage, like prescription drug, dental and vision.

Medicare Supplement insurers can't reject you if you sign up for Medicare during your seven-month initial enrollment period. If you sign up after your initial enrollment period, you may be subject to medical underwriting, which could disqualify you from Medicare Supplement Insurance.

Add to Your Coverage

Medicare Supplement plans don't cover prescription drugs, vision care or dental care.

- Go to Prescription Drugs page

Prescription Drugs

(Part D) - Go to Vision Insurance page

Vision Insurance

- Go to Dental Insurance page

Dental Insurance

Medicare Supplement (Medigap)

Call a licensed insurance agent at 877-842-5883

Call a licensed insurance agent at 877-842-5883 (Hours of operationOpens Popup)

For TTY device, dial 711.

(Hours of operation Opens Popup)Medicare Supplement (Medigap)

Call a licensed insurance producer at 877-842-5883

Call a licensed insurance producer at 877-842-5883 (Hours of operation Opens Popup)

For TTY device, dial 711.

(Hours of operation Opens Popup)- Initial Enrollment Period

- Your Initial Enrollment Period into Medicare is a 7-month period (3 months before the month of your 65th birthday, the month of your birthday and the 3 months after) when you may enroll in Medicare Parts A and B.

- Open Enrollment Period

- Your Medicare Supplement (Medigap) Open Enrollment Period lasts for 6 months, and begins on the first day of the month in which you're both 65 or older and enrolled in Medicare Part B.

- Hours of Operation

- Monday to Friday: 7:30 a.m. to 6 p.m. CT

- Saturday and Sunday: Closed

- Note: Days and times may vary

- Medicare Part A

-

This covers inpatient hospitalization, rehabilitation and long-term hospital services. Keep in mind, Medicare Part A might leave you with coinsurance payments that a Medicare Supplement plan may pay.

- Medicare Part B

-

This covers medical services, like doctor visits and outpatient care. Keep in mind, Medicare Part B might leave you with coinsurance and copayments that a Medicare Supplement plan may pay.

- Blood Transfusions

-

This is coverage that can be used for blood transfusions. If the hospital (Part A) or provider (Part B) has to buy blood for you, a Medicare Supplement plan may pay for the first three pints for each year.

- Hospice Care Coinsurance or Copayment

-

This is a care program for people who are terminally ill. A Medicare Supplement plan can pay for coinsurance and copayments associated with this program.

- Skilled Nursing Facility

-

This is a facility that provides staff and equipment for procedures that can only be performed by a registered nurse or doctor. Some Medicare Supplement plans can help pay for a patient's stay.

- Medicare Part A Deductible

-

This is the amount you have to pay for hospital services each year before your health insurance begins to pay. These amounts can change every year.

- Medicare Part B Deductible

-

This is the amount you have to pay for medical services each year before your health insurance begins to pay. These amounts can change every year.

- Medicare Part B Excess Charges

-

This is the difference between the amount a health care provider can charge for a service and the amount Medicare pays for it. Some Medicare Supplement plans can help pay these charges.

- Foreign Travel Emergency

-

This is coverage for medical services outside the United States. Some Medicare Supplement plans can help pay for emergency care in a foreign country, if the treatment begins during the first 60 days of your trip and Medicare doesn't cover it.